THE 2018 ULTIMATE GUIDE TO

GUARANTEED

RETIREMENT

INCOME

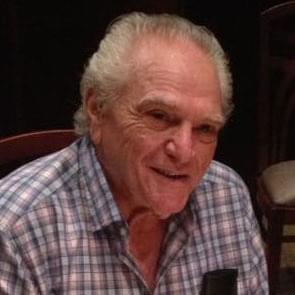

ABRAHAM ROSNER

THE 2018 ULTIMATE GUIDE TO

GUARANTEED

RETIREMENT

INCOME

ABRAHAM ROSNER

Do you worry about any

of these scenarios?

Loses in the pre-retirement and early retirement years will devastate a retirement income stream and may be irreparable.

Unplanned income withdraws and fund loses will increase the probability of running out of income.

Potential Depletion of your money

You are giving too much away in Taxes?

Most retirement accounts are subject to taxes like income taxes, capital gains taxes, state taxes, capital gains taxes, dividends and interest, estate taxes and more.

AMERICAN INCOME FUND

CALL US 800 820 8123

Do you worry about any

of these scenarios?

Losing your invested retirement money

Not having enough money to retire

Unplanned income withdraws and fund loses will increase the probability of running out of income.

Potential Depletion of your money

Retirees need to have their assets grow more than their withdraw and loss rate. Every year taxes, inflation, management fees and charges, market volatility, low interest rates and their account withdraws, will deplete their nest egg.

You are giving too much away in Taxes?

Most retirement accounts are subject to taxes like income taxes, capital gains taxes, state taxes, capital gains taxes, dividends and interest, estate taxes and more.

EVEN WORSE

If you don’t have the right plan

You will out live your retirement money

Life expectancies today are greater than ever because of our available healthy food, the unending advancements in modern medicine and the booming technology in medical procedures and applications. When Social Security was first enacted in 1933, the average life expectancy for a male was about 59 years old…and yet Social Security didn’t start paying benefits until age 62!

Without the right planning you could very well be facing these grim scenarios.

AMERICAN INCOME FUND

CALL US 800 820 8123

If you don’t have the right plan

You will out live your retirement money

6 Misconceptions stopping you

from buying an annuity

& possibly damaging your retirement

1. Living isn’t scary

Life expectancies today are greater than ever because of our

available healthy food, the unending advancements in modern

medicine and the booming technology in medical procedures and

applications. When Social Security was first enacted in 1933, the

average life expectancy for a male was about 59 years old…and

yet Social Security didn’t start paying benefits until age 62!

Most retirement planners have very little incentive to recommend

plain annuities. Unlike variable annuities (complicated products

that come laden with fees) immediate annuities offer salespeople

very little financial reward. In fact, once a retiree buys an annuity,

all he has to do is sit back and cash checks for the rest of his life.

That makes it hard for investment advisers to justify taking an

annual cut of the retiree’s assets.

3. Underestimating the odds

Retirees tend to underestimate the chances they will live to a ripe

old age. In 1970, the average 65-year-old woman could expect to

make it to 82. Today, a 65-year-old woman survives, on average,

to 85. More than one in five 65-year-olds of either gender will

make it into their nineties. Centenarians, once a rare species, are

becoming downright common.

AMERICAN INCOME FUND

CALL US 800 820 8123

& possibly damaging your retirement

Life expectancies today are greater than ever because of our available healthy food, the unending advancements in modern medicine and the booming technology in medical procedures and applications. When Social Security was first enacted in 1933, the average life expectancy for a male was about 59 years old…and yet Social Security didn’t start paying benefits until age 62!

2. Your advisor hasn’t recommend it

Most retirement planners have very little incentive to recommend plain annuities. Unlike variable annuities (complicated products that come laden with fees) immediate annuities offer salespeople very little financial reward. In fact, once a retiree buys an annuity, all he has to do is sit back and cash checks for the rest of his life.That makes it hard for investment advisers to justify taking an annual cut of the retiree’s assets.

3. Underestimating the odds

Retirees tend to underestimate the chances they will live to a ripe old age. In 1970, the average 65-year-old woman could expect to make it to 82. Today, a 65-year-old woman survives, on average, to 85. More than one in five 65-year-olds of either gender will make it into their nineties. Centenarians, once a rare species, are becoming downright common.

4. Invested in the stock market instead

The problem with gambling on stocks, as older folks are now

learning, is that if your retirement coincides with a bear market, you

can wind up broke. Typical retirement planning tries to minimize

this risk by keeping a large slug of bonds & cash in your portfolio,

but even well-diversified investors have suffered bear markets.

5. Wanting to leave something for your kids

Period certain’ annuities come with a guarantee that, even if

you get hit by a bus the day after buying an annuity, checks will

continue for a fixed period and can be cashed by your heirs.

6. Thinking you won’t be able to access

your funds

Proper retirement planning includes having an emergency fund

available for those unexpected events. The right annuity will offer

the flexiblity for you to access your funds in case of an emergency

without losing the principle you have invested.

AMERICAN INCOME FUND

CALL US 800 820 8123

4. Invested in the stock market instead

The problem with gambling on stocks, as older folks are now learning, is that if your retirement coincides with a bear market, you can wind up broke. Typical retirement planning tries to minimize this risk by keeping a large slug of bonds & cash in your portfolio, but even well-diversified investors have suffered bear markets.

Period certain’ annuities come with a guarantee that, even if you get hit by a bus the day after buying an annuity, checks will continue for a fixed period and can be cashed by your heirs.

6. Thinking you won’t be able to access your funds

Proper retirement planning includes having an emergency fund available for those unexpected events. The right annuity will offer the flexiblity for you to access your funds in case of an emergency without losing the principle you have invested.

The most frequently asked

annuity questions

What amount is your minimum investment?

Our minimum investment is $25,000.

What is the minimum age to open an account?

All applicants must be at least 18 years of age.

Will you share my private information with anyone?

No, we will never share your private information without the account holders prior consent.

Do I need to be an American citizen to open an account?

No you do not need to be a USA citizen to open an account. We do require a copy of a government issued identification.

Is the interest earned taxable?

Do you charge a monthly or annual fee?

We do not charge a monthly or annual service fee.

When is interest compounded?

Interest is compounded annually & credited monthly based on the daily collected balance.

The most frequently asked annuity questions

What amount is your minimum investment?

Our minimum investment is $25,000.

What is the minimum age to open an account?

All applicants must be at least 18 years of age.

No, we will never share your private information without the account holders prior consent.

Do I need to be an American citizen to open an account?

No you do not need to be a USA citizen to open an account. We do require a copy of a government issued identification.

Is the interest earned taxable?

Yes, however the interest is tax deferred. This means that you pay tax only when the maturity comes due or is cashed prematurely. Interest is taxable by the federal government, state or local governments. Consult with a tax professional prior to liquidating the investment.

Do you charge a monthly or annual fee?

We do not charge a monthly or annual service fee.

When is interest compounded?

Interest is compounded annually & credited monthly based on the daily collected balance.

The most frequently asked

annuity questions – Cont.

Will I receive a paper statement monthly?

No, we do not offer paper statements by mail. Currently all account balance inquiries must be made by phone or via email.

Is there a withdrawal penalty?

Yes, there is a penalty for withdrawing principal prior to the maturity date. Your interest income earned will be adjusted to reflect the changed terms. In addition no interest will be earned for partial years.

How can you offer such high returns?

What fees do you charge?

We earn the difference between what we pay you and what the annuities pay out. You will never be charged unless you received the listed interest rate for the annuity offering you signed up with.

Why should I invest?

You should invest because you would like to receive stable consistent income and banks are not paying you enough. If you are seeking a passive fixed income solution, annuity is the way to go.

AMERICAN INCOME FUND

CALL US 800 820 8123

The most frequently asked annuity questions – Cont.

Will I receive a paper statement monthly?

No, we do not offer paper statements by mail. Currently all account balance inquiries must be made by phone or via email.

Is there a withdrawal penalty?

How can you offer such high returns?

Our annuities invest in global bond funds that have never defaulted that offer us a premium rate of return which we pass on to our clients.

What fees do you charge?

We earn the difference between what we pay you and what the annuities pay out. You will never be charged unless you received the listed interest rate for the annuity offering you signed up with.

You should invest because you would like to receive stable consistent income and banks are not paying you enough. If you are seeking a passive fixed income solution, annuity is the way to go.

My personal story on the road to Retirement

Owning a sum of money that I wanted to live off

My personal story on the road to Retirement begins at age 31 when I retired from owning & running multiple hotels/bars/restaurants in Florida. I was left with a large amount of liquid funds that I planned on living o without depleting.

The available options out there are unattractive

After doing extensive research, I found that almost all annuities out there have high penalty Surrender Charges of up to 25% (known as early withdrawal penalties), Huge Commissions of up to 15% (paid to insurance agents only concerned with their fees, not your performance) and having your funds tied up for an indefinite period.

I built my own Annuity & had great results

Now Offering the same opportunity to you

That is why I decided to leave Retirement early and am now offering the exact same Retirement Income Solution to those seeking better alternatives to traditional insurance companies.

AMERICAN INCOME FUND

CALL US 800 820 8123

My personal story on the road to Retirement

Owning a sum of money that I wanted to live off

My personal story on the road to Retirement begins at age 31 when I retired from owning & running multiple hotels/bars/restaurants in Florida. I was left with a large amount of liquid funds that I planned on living o without depleting.

After doing extensive research, I found that almost all annuities out there have high penalty Surrender Charges of up to 25% (known as early withdrawal penalties), Huge Commissions of up to 15% (paid to insurance agents only concerned with their fees, not your performance) and having your funds tied up for an indefinite period.

I built my own Annuity & had great results

I I decided to Build My Own Annuity Pension & quickly realized the Annuity that I built for myself had become a stable source of income, offered me instant diversification from stocks, offered a high rate of return and the principal amount was preserved.

Now Offering the same opportunity to you

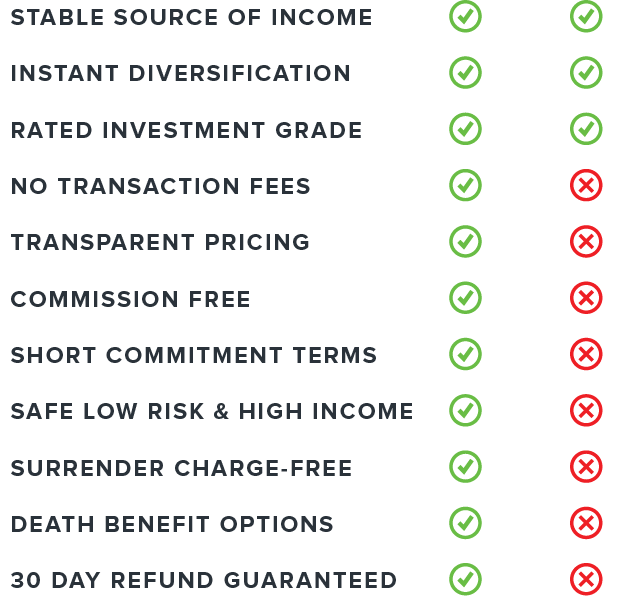

Why buy the American Income Fund Annuity?

We have engineered the perfect annuity

American Income Fund

Traditional Insurance Company

STABLE SOURCE OF INCOME

INSTANT DIVERSIFICATION

RATED INVESTMENT GRADE

NO TRANSACTION FEES

TRANSPARENT PRICING

COMMISSION FREE

SHORT COMMITMENT TERMS

SAFE LOW RISK & HIGH INCOME

SURRENDER CHARGE-FREE

DEATH BENEFIT OPTIONS

30 DAY REFUND GUARANTEED

AMERICAN INCOME FUND

CALL US 800 820 8123

Why buy the American Income Fund Annuity?

We have engineered the perfect annuity

SO IMAGINE THIS

The peace of mind of knowing you

have retirement income for life

Ability to pass on the investment to

your loved ones when you die

Getting a “Guaranteed” withdrawal

benefit

Gaining all the Taxation benefits

Beating inflation

Having the comfort to accessing your

funds incase of an emergency

Want to know if an Annuity is right for you?

AMERICAN INCOME FUND

CALL US 800 820 8123

SO IMAGINE THIS

The peace of mind of knowing you have retirement income for life

Ability to pass on the investment to your loved ones when you die

Getting a “Guaranteed” withdrawal benefit

Gaining all the Taxation benefits

Beating inflation

Having the comfort to accessing your funds incase of an emergency

What clients say about me

We worried about many things but now I can finally sleep peacefully knowing I can never outlive my savings using the simple strategy I learned from AIF!

Eugene Roberts, FL

I was new to retiring and unsure what options were available for me. With the information AIF sent me for free I was able to make the best decision possible.

Manuel Steinman, CA

My spouse passing away left the family’s financial responsibilities on my shoulders. Thank God I found AIF videos and learnt what needed to be done :)

Helen Gold, NY

AMERICAN INCOME FUND

CALL US 800 820 8123

What clients say about me

We worried about many things but now I can finally sleep peacefully knowing I can never outlive my savings using the simple strategy I learned from AIF!

Eugene Roberts, FL

I was new to retiring and unsure what options were available for me. With the information AIF sent me for free I was able to make the best decision possible.

Manuel Steinman, CA

My spouse passing away left the family’s financial responsibilities on my shoulders. Thank God I found AIF videos and learnt what needed to be done :)

Helen Gold, NY